Order with HSA/FSA

Order with HSA/FSA

Use Your HSA/FSA Funds for Nordic Naturals Purchases.

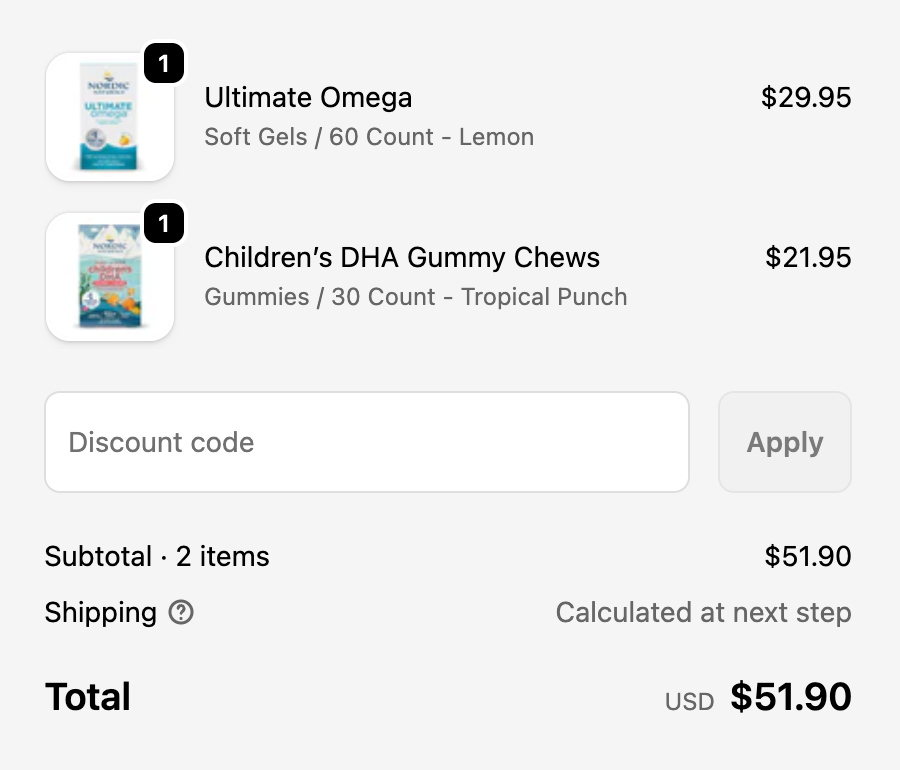

1. Add products to your cart

If logged in to Shop Pay, check out as a guest.

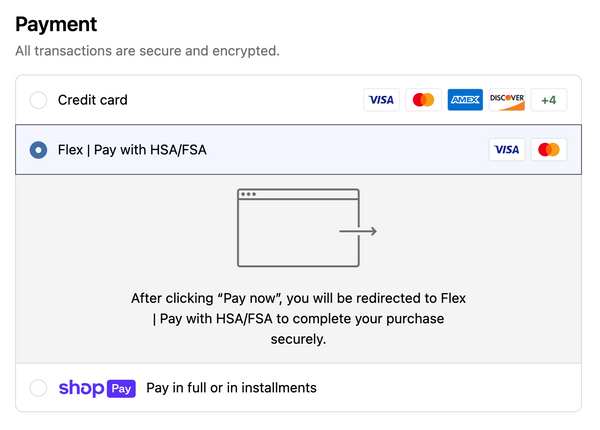

2. Select Flex | Pay with HSA/FSA

Choose Flex | Pay with HSA/FSA as your payment option at checkout.

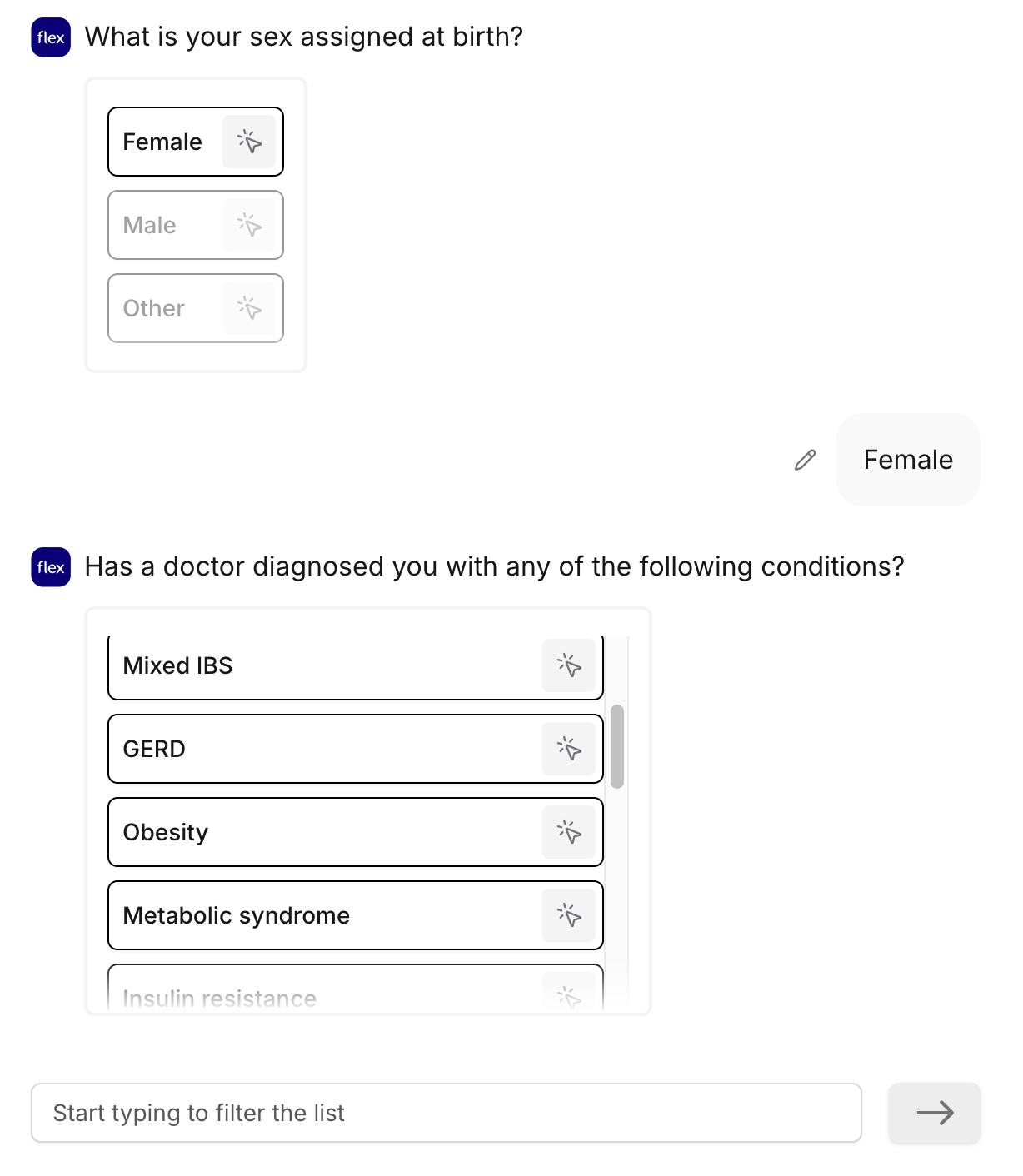

3. Confirm eligibility

Complete the short survey.

4. Enter your HSA or FSA debit card details

Complete your checkout as usual. If you don’t have your HSA or FSA debit card handy, you can also complete the checkout with a regular credit or debit card.

Flex will email you both a Letter of Medical Necessity as well as an itemized receipt within 2 hours of your purchase. Keep these documents for your records, should your HSA/FSA provider or the IRS require additional documentation.

Your HSA/FSA Questions, Answered

For more information, check out the FAQ below or reach out to [email protected]

HSA/FSA Payment & Reimbursement Questions

Nordic Naturals has partnered with Flex to allow eligible customers to use their Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you can now use your HSA or FSA debit card to buy your favorite Nordic Naturals supplements with pre-tax dollars, resulting in net savings of 30-40%, depending on your tax bracket.

The IRS oversees HSA and FSA eligibility and dictates that a customer must have a wellness need they seek to support with Nordic Naturals products. Customers must have documentation that confirms their eligibility, also called a Letter of Medical Necessity. Not to worry, we have partnered with Flex to make this a quick and easy process for customers.

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you may be in Shop Pay. Select “checkout as guest” to view more payment options.

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and Flex will email you an itemized receipt to submit for reimbursement.

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Reach out to your HSA/FSA administrator to confirm your balance.

Please email [email protected] the request from your FSA, and the Flex team will issue you a new receipt.

Please check your spam folder, as sometimes emails from [email protected] may be automatically filtered as spam by some email service providers. If you still can’t find it, please email [email protected] and let them know the email address associated with your order.

No, unfortunately, this isn’t a supported feature right now. If there are insufficient funds in a single HSA or FSA account, you can instead enter a credit card on the Flex checkout page. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex, which you can submit for reimbursement.

We apologize for the discrepancy. Please contact [email protected]. We’ll review the charges and get back to you with details of the likely refund shortly.

Sales tax for eligible items is also covered by HSA/FSA funds. If the customer has a split cart, the tax will be divided among the cards based on the items.

We strongly recommend checking with your HSA/FSA provider to see if a purchase is eligible prior to completing the purchase. However, if you believe your claim has been wrongly denied, please send over any response from your HSA/FSA provider to us so we can share it with Flex and receive guidance on the next best steps to take. Please note that employer-sponsored FSAs can determine what products are eligible beyond the IRS’s guidelines, so it’s extremely important to check prior to purchase.

The ability to apply for FSA reimbursement in a future calendar year depends on the policy of the specific FSA provider. Most FSA administrators require that the purchase be made during the time of coverage. For example, if the FSA coverage is for 2025, all purchases typically need to be made and/or submitted for reimbursement within that coverage period.

However, some administrators may have more flexible rules regarding the timing of when the expense occurred. We recommend that customers review their plan policy to confirm the details.

Note: Health Savings Accounts (HSAs) are different and generally allow for reimbursement at any time, even in future years.

Unfortunately, for purchases made without using Flex in the checkout to receive an itemized receipt, it may be difficult to apply for reimbursement.

For Health Savings Accounts (HSAs), consumers can use an itemized receipt for reimbursement anytime after they have made the purchase, even if it is many years later.

For Flexible Spending Accounts (FSAs), most accounts require that the purchase was made in the calendar year during which the consumer had the FSA, as FSAs typically do not roll over. Some FSAs offer a buffer window, allowing customers additional time to submit receipts for expenses incurred during the previous calendar year.

Complete your health consultation: Complete a quick, 2-minute consultation. A licensed provider will determine your eligibility. If eligible, you’ll receive a Letter of Medical Necessity in under two hours.

Make your Nordic Naturals purchase: Visit Nordic Naturals to pay for your order with a standard payment method. Do not use your HSA/FSA card at checkout.

Submit for HSA/FSA reimbursement: Follow Flex’s instructions to submit your Letter and Life Time receipt to your HSA/FSA administrator for reimbursement.

Locate your HSA/FSA administrator (typically through your employer’s HR department or health insurance provider).

Log in to your account on the administrator’s online platform.

Navigate to the “Reimbursement” or “Claims” section.

Upload your Letter of Medical Necessity and receipts for related purchases made after the letter’s issue date.

Submit your claim. Processing can take several days to a few weeks.

Reimbursement times vary but can take several weeks. For a specific timeline, contact your HSA or FSA administrator directly.

Letter of Medical Necessity Questions

Some products require documentation from a licensed healthcare provider stating that the item is necessary to treat or manage a specific medical condition. If the product requires a Letter of Medical Necessity (LOMN), Flex facilitates a chat-based consultation that generates the Letter in real time.

In order to qualify to use your HSA or FSA card for Nordic Naturals products, the IRS requires you to have a Letter of Medical Necessity. Nordic Naturals has partnered with Flex to enable asynchronous telehealth visits as part of our checkout. Within 24 hours of your purchase, Flex will email you both an itemized receipt.

You should keep it on file for at least three years in the event of an IRS audit of your HSA or FSA account. Occasionally, FSAs may ask for the Letter to confirm the eligibility of your purchase.

Please email [email protected] and they will reach out to their telehealth team to reprocess and send your corrected Letter of Medical Necessity.

Please contact [email protected]. This may be a time zone issue. Our partners at Flex will review the case and reissue the Letter with an updated date.

Please contact [email protected] for more assistance.

Please check your spam folder, as sometimes emails from [email protected] may be automatically filtered as spam by some email service providers. If you still can’t find it, please email [email protected] and let them know the email address associated with your order.